Tactical Positioning

With the US Federal Reserve (“Fed”) turning a little more cautious over the last two weeks, markets have traded in a volatile pattern finishing the month in negative territory. In recent days we have started to see some weaker than expected US economic data including Consumer Confidence hitting a 2-year low, home sales declining and US personal savings slumping to a 10-year low point of just 3.6%. We think that as soon as we see rate cuts in Europe and the UK (starting in June) markets will start to assume a more optimistic tone on the prospect for further rate cuts especially if weakening US data persists. With this in mind, current weakness may turn out to be another reasonable buying opportunity for both bonds and equities.

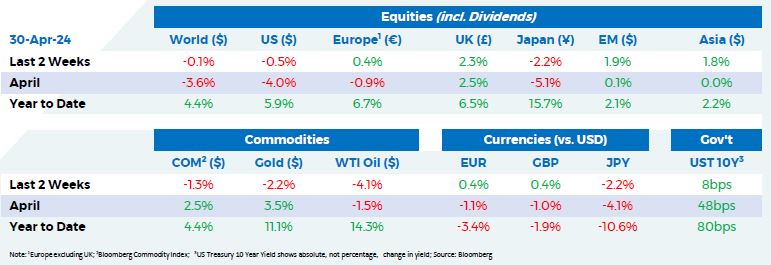

Market Moves

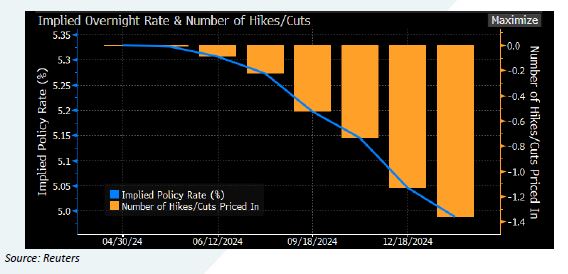

Cuts to rate cut expectations

The Fed’s interest rate policy meeting took place on the 1st May (just after the period of this bulletin) and as expected the committee decided to make no changes to interest rates. This is in line with expectations but significantly different from the consensus view earlier this year that rate cuts would begin in May. Hopes of rate cuts this year continue to fade given continuing inflation, as confirmed by the Fed’s preferred measure, the Core Personal Consumption Expenditures Price Index (“PCE”), which rose 2.8% year-on-year to March, slightly more than expected. However, Fed Chair Jerome Powell made it clear that the committee is still intending that their next move will be to cut rates.

Growth expectations were also knocked by lower than expected gross domestic product (“GDP”) as a result of softer consumer spending. In the first quarter of the year, growth in the US increased at an annualised rate of 1.6% versus 2.5% expected, sparking concerns around stagflation. With inflation remaining sticky and growth decelerating, the swap market is now indicating only one cut for all of 2024.

Corporate earnings are ahead of forecasts

The first quarter’s earnings results season in the US is well underway with almost half of firms on Wall Street having reported results and close to 80% reporting a positive earnings per share surprise. Around 60% of these companies have also beaten revenue estimates.

Tesla was the first of the large leading technology focused US companies to report and missed both revenue and earnings forecasts. However, investors reacted positively to comments on the prospect of cheaper models, resulting in a 16% gain for the week. Meta reported the next day and beat both top and bottom line expectations, but its share price ended 10% lower on the week as investors were spooked by warnings of lower projected revenues owing to the huge cost of spending on artificial intelligence (“AI”) projects.

The following day, Alphabet and Microsoft beat market expectations owing to AI-boosted growth in their cloud businesses. Subsequently, Amazon also reported strong results beating on both profit and revenue as it enjoyed greater customer interest in AI. Alphabet took things a step further by announcing their first dividend as well as a $70 billion buyback, leading to over a 10% surge in its share price over the week.

The rise, fall and rise of DJT

Donald Trump’s stake in Trump Media & Technology Group, the parent company behind Trump’s Truth Social media platform, has risen in value to almost $5.7 billion, based on the 30th April closing price of the stock. In March, Trump Media began publicly trading under Trump’s initials, DJT, after merging with Digital World Acquisition Corp. Due to a provision in the merger agreement, Trump received an earnout bonus of 36 million shares. This brings his total holding to around 115 million shares. Although Trump is bound by a six-month lockup period meaning he would not be able to sell his shares until September, a waiver could be granted by the company’s board to allow him to sell out of his position earlier. As the former US president faces a

barrage of legal challenges, the potential windfall could be a welcome one.

In its first month of trading, the stock has been extremely volatile, trading close to $80 on its first trading day. During the weeks following its listing, the stock fell to below $23 after the company disclosed an annual net loss of $58 million on revenue of around $4 million as well as registering millions of shares for sale. The company’s stock price has doubled since then. The latest rally has been supported by the company’s efforts to protect against short selling by releasing instructions to shareholders on how to request excluding their shares from being used in short selling trades. The stock is now trading at almost $50 as both Trump and his social media company continue to make the headlines.

Economic Updates

Consumer confidence in the US fell for the third month in a row in April, with the Conference Board Consumer Confidence Index retreating to 97.0, down from 103.1 in March and below the forecast of 104.0.

The UK Consumer Price Index (“CPI”) for March increased by 3.2% on an annual basis, down from 3.4% the previous month but marginally higher than the 3.1% forecast. CPI data was also released by Canada and Australia. In Canada, annual inflation increased to 2.9% from 2.8% in February and in Australia CPI rose 3.6% year-on-year, higher than the 3.4% forecast but lower than the 4.1% print in the previous month.

Flash PMI data was released for the UK, US, France and Germany. In the UK, the private sector expanded with the composite rising to 54.0 from 52.8 in March (A number above 50 is indicative of higher demand). In France, the composite PMI increased to 49.9, up from 48.3 in March, as business activity across the private sector economy stabilised. There was also a modest expansion in private sector business activity in Germany, with the composite at 50.5 compared with 47.7 in March. In the US, the rate of expansion of business activity slowed to 50.9 from 52.1 in March.

In Japan, the central bank kept interest rates unchanged at 0% – 0.1%. Following this, the yen weakened against the dollar past

the 160 mark after hitting 155, leading to speculation of possible intervention by the Japanese authorities.

Download the bulletin here.