Tactical Positioning

As suggested in our last Bulletin, markets have paused over the last two weeks and this may continue a little longer. Where clients have above average levels of cash earmarked for investment, we suggest adding to equity and bond exposure. The next US CPI report is due on February 13th for the month of January and the headline rate could dip below 3%, possibly as low as 2.7% dragged down by weak energy prices in the last 4 weeks of 2023. Despite disruption in the Red Sea, the oil price has barely moved in the last 2 weeks and broader markets remain sanguine that we are unlikely to see a significant increase in fighting in the Middle East. Overall, there is a good chance that markets will deliver more upside in the coming weeks helped by decent Q4 corporate results (currently underway) and lower inflation data.

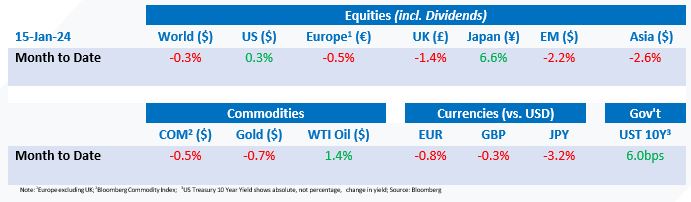

Market Moves

Inflation insights

The Consumer Price Index (“CPI”) data is usually closely watched by investors as it is a lead indicator of future central bank policy and acts as a score sheet as to the success of monetary policy in controlling or taming inflation. Thursday’s CPI release in the US saw the headline figure surprise marginally to the upside (+3.4% on an annual basis, compared with forecasts of +3.3%) and ‘core’ inflation, which excludes the volatile effects of food and energy prices, also coming marginally ahead of forecasts with an annual reading of 3.9%, against a prediction of 3.8%. This was slightly disappointing although Treasury yields fell on the day and having initially sold off equities managed to regain most of their losses to finish flat on the day. The Federal Reserve (“FED”) still has some way to go to reach its inflation target of 2%, but it seems to be heading in the right direction.

Market pricing points to the Federal Funds Rate (currently 5.25% – 5.50%) probably falling faster than the FED is indicating. Despite Cleveland Federal Reserve President Loretta Mester indicating that March was “probably too early” to start cutting rates, futures are currently pricing in an 83% chance, at the time of writing.

Shine bright like a Dimon

With Q4 earnings season getting underway in the US, JP Morgan announced an eyewatering and record-breaking profit of $49bn for the year with its loan department profiting from 2023’s high interest rate environment. Despite reporting a decline in fourth quarter profits, JP Morgan left its competitors in its wake, with the likes of Citigroup announcing its worst quarter in 15 years owing to expansive job cuts, Bank of America seeing its profits shrink in the final quarter of the year, and Goldman Sachs reporting its lowest annual profits in 4 years. JP Morgan CEO, Jamie Dimon, said, “we remain confident in our ability to continue to deliver very healthy returns.” The company’s shares, which rose 26% in 2023, and recently touched an all-time high, moved up 2% on the news.

Tokyo triumphs

Yen weakness, a flourishing export industry and strong investor optimism helped Japan’s leading index, post a knockout performance of +31% in 2023, marking its best year in a decade. This flurry has continued into the first two weeks of the new year and Japan’s stock market has outpaced all other major markets to reach fresh highs. The market is now only around 10% below the levels it reached in 1989. However, if we adjust for the fall in the yen last year the market slightly underperformed other markets in dollar terms.

Bitcoin, a step towards the mainstream?

The US Securities and Exchange Commission (“SEC”) granted approval for a spot Bitcoin ETF over the fortnight, with applications from well-known ETF issuers such as iShares, Wisdom Tree and Fidelity, all given the green light to commence trading. This was a celebrated moment for the world’s largest cryptocurrency as the landmark decision will increase the accessibility for both retail and institutional investors. After posting a return of 150% in 2023 alone, its first day of spot ETF trading saw $4.6bn change hands. We remain cautious about cryptocurrencies as an asset class, but the move to ETF trading is a positive step for crypto enthusiasts.

Economic Updates

After Thursday’s pedestrian CPI print, the US Producer Price Index (“PPI”) release, an inflation measure which looks more closely at the change in prices from a commercial / wholesale level, came in below forecasts (whilst ‘core’ PPI remain unchanged), which crucially provides further oxygen to the argument that the FED can begin cutting rates soon.

Initial jobless claims, a statistic which shows the number US individuals applying for unemployment insurance benefits in the US, came in lower than anticipated at 202k versus an expected reading of 210k, the lowest reading since October, showing the resilience of the US economy.

Download the bulletin here.