TACTICAL POSITIONING

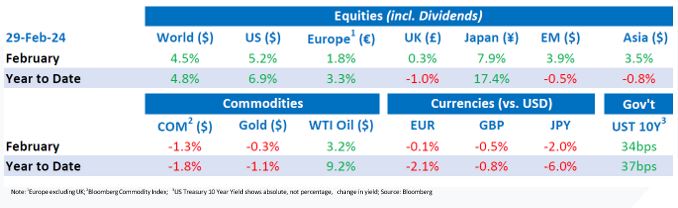

We have been monitoring equity markets for evidence that the narrowness of the rally, with most of the gains in the US equity market coming from just seven enormous companies (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla), would broaden to the rest of the market. News this year has given us conflicting evidence. On the one hand Tesla has seen its share price fall 30% since the start of the year before making a partial recovery and we have started to see good performance from a broader range of companies and markets with the Japanese market generating the highest return of the major indices this year. On the other hand, as detailed below Nvidia announced very strong results during the fortnight, highlighting the reason behind investor focus on these seven. Its shares have risen over 60% this year. We are keeping our balance by maintaining our exposure and investing in both these long-term growth companies and diversifying portfolios to a wider range of companies in expectation that the rally will broaden out.

MARKET MOVES

NVIDIA mania

On 21 February Nvidia announced fourth-quarter earnings for 2023 with revenues rising 22% from the previous quarter and by 265% from a year before with data centre revenue up over 400% on the year. The company’s GPUs (Graphics Processing Units) known for their use for computer gaming are in high demand for use in Artificial Intelligence. The shares rose 16% following the results, adding $277bn to its market capitalisation, the largest single trading session gain in value of all time. This took Nvidia to a market capitalisation of $2 trillion and the 4th biggest company in the world. In the first two months of this year the stock is up 60% and its increase in value is equivalent to nearly 80% of the combined market value of Europe’s two largest listed companies (Novo Nordisk and ASML).

The ‘land of the rising sun’ rises once again

Japan is back in favour with investors. On Feb 22nd, Japan’s main equity index rose above its all-time high after a 34-year hiatus. The market had risen in a parabolic manner in the late 1980s and its return to its 1989 peak provides psychological closure for those who started investing when the Japanese market was the world’s largest by capitalisation. The previous high was reached when the country experienced an economic bubble driven by easy credit and speculation in which real estate and stock market prices reached astronomic levels. It is worth noting that although the index now stands at a similar level corporate earnings are around 3 times higher than they were in 1989.

Japan’s rally of over 17% since the start of this year makes it the world’s best-performing major index over the two month period. It has been buoyed by microchip-related stocks and the weakness in the yen is boosting the profits of export-focused companies that have a heavy weighting in the index. Demand for equities has been bolstered as investors have pivoted away from China’s market owing to the country’s slowing economy and geopolitical tensions.

A market sentiment indicator?

The volatile and speculative asset class of cryptocurrencies is currently experiencing a surge which highlights the risk-on tone we’ve seen in markets so far this year. Bitcoin reached $64,000 on the last day of February, close to its $69,000 peak. The rise has been supported by new demand from recently authorised exchange-traded funds which have seen more than $7 billion of net inflows in less than two months.

What sort of economic landing?

Market expectations for central bank policy have fluctuated between the official guidance of relatively slow interest rate cuts to anticipation of aggressive policy easing. Markets are currently pricing in a 79% probability of a rate cut in the US by June with a total of three to four 25 basis point cuts by the year end. US bonds repriced in line with policy expectations, with the 10 year US Treasury yield rising from 3.88% to 4.26% this year. In Europe, interest rates are also expected to start falling by June with euro rates expected to end the year 2% lower at 2.5% with UK rates falling less rapidly to 4%, despite the news that the economy entered into a recession in the last quarter of 2023.

ECONOMIC UPDATES

In a generally quieter fortnight of data releases, the focus was on US inflation with the Core PCE (Personal Consumption Expenditure) Price Index rising to 0.4% for the month although falling to 2.8% over 12 months. Both of these were in line with consensus. Initial jobless claims were slightly higher than expected at 215K (vs 209K expected) but still leave unemployment at a relatively low 3.7%. The final publication of Q4 US GDP was 3.2% versus an initial estimate of 3.3% and Q3’s large increase of 3.9%. On the negative side, a leading US Purchasing Managers Index “PMI” fell to 44.0 (VS 48.1), indicating a contraction in manufacturing. Consumer confidence also surprised on the downside, falling to 106.7 versus 110.9 expected although this is still above the average level of the past 15 years.

Download the bulletin here.